The premium subscriptions page of VRPorn.com has listed Litecoin has one of its payment options. VRPorn.com, which claims to be the numero uno of virtual reality porn, uses GoCoin to process Litecoin payments.

The premium subscriptions page of VRPorn.com has listed Litecoin has one of its payment options. VRPorn.com, which claims to be the numero uno of virtual reality porn, uses GoCoin to process Litecoin payments.

Notably, GoCoin allows companies to accept several more cryptocurrencies besides Litecoin. For example, travel booking site CheapAir accepts Bitcoin Cash, Dash and Litecoin using GoCoin as payment processor.

A month before, another popular adult website Pornhub announced that it will start accepting Verge (XVG) as payment. Charlie Lee, the creator of Litecoin (LTC) got in touch with Pornhub to check whether they will be interested in accepting Litecoin as well.

However, Pornhub used the opportunity to question him about selling all his Litecoin (LTC) holdings. In case of VRPorn.com, there is no clarity as to who made the first contact. VRPorn.com has not issued any official statement at the time of writing this article. However, Litecoin is a payment option on its website. Unofficial statistics peg the average number of visitors to 200,000 per day.

Notably, the Vice Industry Token (VIT) had recently revealed that it will be accepted as a payment option in more than twenty adult websites, including the one run by Stormy Daniels. VIT, which was custom built for the porn industry, allows users to earn while watching content. The money earned can be used to buy premium content in other affiliated sites.

A new law is being put forward in Switzerland that will allow local casinos the chance to offer online versions of poker, roulette, and blackjack. This will go forward if a majority of voters vote in favor of ‘The Money Gaming Act’ on June 10.

A new law is being put forward in Switzerland that will allow local casinos the chance to offer online versions of poker, roulette, and blackjack. This will go forward if a majority of voters vote in favor of ‘The Money Gaming Act’ on June 10.

The law will not only allow online gambling to be legalized but will also add a layer of protection for Swiss online gamblers.

Switzerland voted on ‘The Money Gaming Act’ back in March 2012. The result was that 87 percent of voters were in favor of legalizing online as there were more benefits than drawbacks from legalizing online gambling.

The new act will not allow foreign casinos to offer online gambling services in the country.

Should the new law be signed into existence, then all casinos offering online gambling services will have to pay taxes to the cantons which will then be used to boost the old age pension fund. This has generated millions of dollars of worth revenue for the fund and the cantons. The cantons are expected to receive around $50.4 million in funding while the old age pension funds will receive around $303 million. Proceeds collected from Swiss lotteries will go directly to community welfare measures. Swiss lotteries tend to support cultural, sports and arts which will all benefit from the additional funding.

The government has decided not to include foreign operators due to the high tax rates being imposed. Legislators believe that foreign operators will not be very interested to enter the Swiss market due to high tax rates as there are other markets out there which have lower taxes for foreign operators. The government is yet to confirm on the final tax rate percentages.

Players Will Be Protected

The new law does offer Swiss players better protection and will prevent them from being exploited by illegal online gambling operators. Swiss Internet Service Providers will be mandated by the new law to block ISPs of foreign casino operators who are not authorized to operate in the country.

Only those operators who already have a Swiss concession will be allowed to offer online gambling services. This ensures that they are already following Swiss laws. The new law will also see another layer of protection added to public lotteries and casinos. There will devices installed on public lottery machines to prevent minors from playing. Casinos will also be more stringent in keeping minors out. This is expected to help curb gambling addiction in the younger generation.

Blockshow Europe 2018, a major international event for showcasing established Blockchain solutions, took place in Berin, Germany on 28-29 May. The event organizers conducted an online survey in which voters selected the women and company they believe are making the greatest impact on the European blockchain sector. The poll was conducted using a blockchain based application named Polys.

Blockshow Europe 2018, a major international event for showcasing established Blockchain solutions, took place in Berin, Germany on 28-29 May. The event organizers conducted an online survey in which voters selected the women and company they believe are making the greatest impact on the European blockchain sector. The poll was conducted using a blockchain based application named Polys.

Nearly 2000 votes were cast for a total of 15 nominees in each category. The nominees for European blockchain companies were selected based on market capitalization, social media activity, and expert reviews. The voters were able to nominate EU-based companies as well.

BitFury, a full-service block chain technology company, won the award in the company category. The company’s website says

We develop and deliver cutting-edge software and hardware solutions necessary for businesses, governments, organizations and individuals to securely move assets across the blockchain.

The BlockShow Europe 2018 was attended by 3,000 people this year. It was five times bigger than the event conducted in Munich last spring, and double the size of BlockShow Asia this past fall. 3,000 people attended the event, which was sponsored by over 90 companies. 93 companies had stalls in the event.

Industry Recognises Achievements of Women

Dr Quy Vo-Reinhard, Chief Data Officer and co-founder of the HIT Foundation, won the award for ‘most influential woman in the industry‘. Dr. Eberhard Scheuer, Elizabeth Chee and Aleksandar Nikov are other co-founders of the organization.

Quy Vo-Reinhard said

I believe the blockchain can bring a bright future to the global community. I was born in a country where, 40 years ago, a majority of people believed women belonged in the kitchen. I feel that I’ve come a long way: being here, speaking, and receiving an award for what I’m doing for women in tech and at the HIT Foundation is amazing. I suggest next year there should be a category for men, too — we all work really hard in this industry. It has nothing to do with gender and everything to do with capability and performance.

The Health Information Traceability (HIT) Foundation is a decentralised marketplace that allows individuals to digitize their health data, monetize and even trace its usage. The platform addresses two major concerns that affect the healthcare industry:

monopolization of health data leading to inefficiencies, and lack of incentives for individuals to digitize and share their health data.

The blockchain technology based platform ensures a meaningful exchange of data in a transparent and secure manner.

Forex settlement provider CLS has invested $5 million in R3 consortium, which is popular for its blockchain-inspired open source distributed ledger platform Corda, in return for a seat on the latter’s Board of Directors.

Forex settlement provider CLS has invested $5 million in R3 consortium, which is popular for its blockchain-inspired open source distributed ledger platform Corda, in return for a seat on the latter’s Board of Directors.

CLS, which has over 60 members and settles transactions worth more than $5 trillion a day, will enable the Forex trade solutions provider to have access to Corda, the only enterprise-grade blockchain platform that removes costly friction in business transactions by enabling institutions to transact directly using smart contracts, while ensuring the highest levels of privacy and security.

The investment is a part of the fundraising program started by R3 a year back. The first two tranches were completed successfully and $107 million was raised from more than 40 fintech companies, including SBI Holdings Inc., Bank of America Corp., HSBC Holdings Plc., Temasek Holdings, and Intel Corp. Apart from CLS, OUE, a Singapore-based real-estate firm, and TIS, a Japanese IT service provider, also invested $5 million each in the third stage of the fund raising program.

Some of the prominent CLS settlement members include Citigroup and JPMorgan Chase. Indirectly, the company’s products are being used by more than 24,000 clients of the settlement members. The advantages offered by blockchain technology continue to attract investments to the tune of 100s of millions of dollars.

R3’s chief executive officer, David Rutter, said

“CLS is critically important to the functioning of one of the most important markets in the world. It is absolutely right that major infrastructure players like this look to technologies such as blockchain to continue making their products and services faster, easier, safer and more cost-effective for the end user.”

Alan Marquard, chief strategy and development officer at CLS, said

“We look forward to working in collaboration with other members to explore how CLS can provide transformative blockchain-based solutions.”

R3, which was launched in September 2015 with the backing of nine large investment banks, has presently over 80 financial institutions as its members.

Gumi, a well known game publisher in Japan, has launched a $30 million global blockchain investment fund. Gumi, the name behind popular games such as Brave Frontier, has stated that it will invest in cryptocurrency and blockchain technology companies.

Gumi, a well known game publisher in Japan, has launched a $30 million global blockchain investment fund. Gumi, the name behind popular games such as Brave Frontier, has stated that it will invest in cryptocurrency and blockchain technology companies.

So far, the investment fund, christened as Gumi Cryptos, has poured funds into four projects, namely Basis, Origin Protocol, Robot Cache, and Pryze.

Gumi Cryptos is headed by Hironao Kunimitsu, founder and CEO of Tokyo-based Gumi, and Miko Matsumura, founder of Evercoin-a US based virtual currency exchange. With a network of investors, the fund will bring a suitable strategic investment partner to the projects it supports.

Commenting on the Gumi fund, Matsumura said

“We’ll be bringing startups from outside of Japan to the Japanese market. We like early stage. We invest in equity or tokens. We like financial services. We like game technologies, and we believe there is a strong connection between gaming and crypto.”

Matsumura has a successful track record of funding startups. He is also a partner of BitBull Capital and an advisor at Arrington XRP Capital. Some of Matsumura’s portfolio of investments includes Lyft, Brave, FileCoin, Civic, Basecoin, Polymath, and Propy. Furthermore, as an advisor, he has successfully assisted startups in raising over $250 million to date. Bee Token, a decentralized AirBnB, and Celsius Network (Crypto Lending Platform) are the two prominent companies created with Matsumura’s assistance.

The Japanese market is complex for investors to understand and access. The Gumi Cryptos fund aims to simplify the process. Japan, the first country to legalize Bitcoin, accounts for more than half of the global Bitcoin trading volume. Even though the regulators are tightening the rules for cryptocurrency exchanges, six more firms have announced their plans to open a cryptocurrency exchange in Japan.

Commenting on the initiative, Hironao Kunimitsu said

“We decided to create a fund that enables us to engage more directly with early-stage blockchain and cryptocurrency startups, in order to be more effective partners and have a real impact in the market. Our team brings tremendous expertise in emerging technology, and with Gumi Cryptos, we can truly partner with these companies as they achieve amazing results for all stakeholders.”

The fact that Serena Williams has won her first round at the 2018 French Open Championships at Roland Garros should not be making headlines considering Williams has won 23 Grand Slam titles and is one of the great female players to have ever played the game.

The fact that Serena Williams has won her first round at the 2018 French Open Championships at Roland Garros should not be making headlines considering Williams has won 23 Grand Slam titles and is one of the great female players to have ever played the game.

However, Williams is making headlines because she is returning to her first Grand Slam tournament after a 16 month break. Williams who was at the top of her game had to take a break to give birth to her first child Olympia and returned to Roland Garros unseeded which caused a lot of controversy as many felt that Williams should have received an exception due to her past performances at Roland Garros and be seeded.

Williams came out firing against Kristyna Pliskova who is ranked 70 and won convincingly 7-6 (4), 6-4. The 36 year old America pro looked fit in a black body suit and sent down 13 aces and broke Pliskova’s serve thrice.

Pliskova did put up a fight though and sent down more aces than Williams. She fired 15 aces but that wasn’t good enough to keep Serena Williams from getting the better of her. Williams was happy that she had a good first match and is looking forward to establishing herself and taking back her crown as the best female tennis player in the world.

Roland Garros

Williams Confident Of Handling Dual Role

There are many who felt that Williams will struggle to reach the top once again as she went through a tough pregnancy and it took a lot out of her. Williams does not have any of these doubts and is confident that she can handle the role of being a hands on mom and also a full time tennis pro.

Ina statement, Williams said

I don’t want her to ever feel like I’m not around. I’m a super hands-on mom. Maybe too much. I’m definitely here to compete and do the best that I can do, obviously. I’m not putting any pressure on myself as I normally do

Her sister Venus Williams who entered Roland Garros as the number 9th seed was eliminated in the first round by Wang Qiang 6-4, 7-5.

Maria Sharapova who may face Serena in the last 16 if both should get that far, had a tough first round Richèl Hogenkamp and took three sets to beat her 6-1, 4-6, 6-3. Sharapova will now play Donna Vekić in round two and will want to win convincingly and gain more confidence.

The entire world is undergoing a big transformation due to the arrival of artificial intelligence, Internet of Things, advanced data analysis, and new financial solutions. However, the arrival of these technologies has increased the demand for computing power at an affordable cost. It is one of the greatest challenges faced by the IT sector.

The entire world is undergoing a big transformation due to the arrival of artificial intelligence, Internet of Things, advanced data analysis, and new financial solutions. However, the arrival of these technologies has increased the demand for computing power at an affordable cost. It is one of the greatest challenges faced by the IT sector.

To overcome the challenges blockchain technology company iExec has released the first ever decentralized cloud marketplace for trading computing power.

Similar to trading commodity on a dedicated exchange, the iExec’s decentralized marketplace enables developers to access secure, affordable, and scalable computing power as and when needed. Presently, TFCloud, Stimergy, Cloud&Heat and Nerdalize are the four cloud providers who have announced their participation in the market. The Proof-of-Contribution algorithm verifies all the off-chain computation executed. This means all transactions between buyers and sellers are securely audited and certified by the algorithm.

The Berlin, Germany-based company has created a new cloud computing model where computing power is traded like a commodity in a global and open market. The iExec marketplace offers computing power in a standardized manner, irrespective of the provider. At any point in time, a developer will have access to large computing power at the best rate.

There are only bare minimum barriers of entry, as the platform is decentralized. Providers of computing power can set their own prices in the P2P market where iExec does not charge any fees. The blockchain based platform provides high level of trust and transparency. The iExec team has launched the marketplace on the Ethereum blockchain. The marketplace uses RLC tokens as the medium of payment.

After entering into the marketplace, “work orders” based on pre-determined categories are placed by users. Likewise, cloud providers present their price quotes for which they are willing to execute computations. More cloud providers and individuals are expected to join the marketplace soon and earn RLC tokens.

The iExec team provided additional details regarding the marketplace during the Blockshow Europe.

This includes “a public and private worker pools, scheduler per pool to manage and organize machine contributions, a new pricing model labeled “pay-per-task” that allows providers to unify resources despite their heterogeneous offers, and finally Proof-of-Contribution (PoCo), a new consensus algorithm for the verification of off-chain computations, ensuring trust on a decentralized marketplace.”

In the meanwhile, the iExec team is continuing with its cybersecurity research program. During Consensus 2018 in New York, the first results with Intel were presented. iExec is also planning to organize a “Worker Contest” where RLC tokens will be granted as prize to the indivduals who come forward to share their machines on the iExec network.

Weiss Ratings, the US-based independent provider of ratings and research for the bank and insurance industries, issued its first letter grade ratings for cryptocurrencies on January 24. Now, for the first time, the ratings agency is allowing non-subscribers to access the complete rating list.

Weiss Ratings, the US-based independent provider of ratings and research for the bank and insurance industries, issued its first letter grade ratings for cryptocurrencies on January 24. Now, for the first time, the ratings agency is allowing non-subscribers to access the complete rating list.

The access is allowed only for a week. Even though, retail investors and to a certain extent institutional investors do not bother much about cryptocurrency ratings, unlike equity markets where a downwardly revised stock will get beaten instantaneously, still, it would be better for cryptocurrency investors to have a look at the ratings, opinion, and the underlying reason behind the rating that was given to a cryptocurrency.

According to the report, the rating of Bitcoin (BTC) was upwardly revised on April 24 to B-. While Bitcoin scores on technology and adoption, it lags behind on risk and reward criteria. Bitcoin Cash (BCH), which continues to stir controversy by calling itself as the original Bitcoin, has received only a score of C-. Weiss ratings has estimated the technology of Bitcoin Cash (BCH) to be weak. Surprisingly, Ethereum (ETH) and IOTA (MIOTA) has received only a B- rating, where as Cardano (ADA), EOS(EOS) and Decred (DCR) have received a rating B. Likewise, Ripple (XRP) has also received a rating of B-. Weiss considers IOTA’s technology to be good, whereas Cardano’s technology to be excellent.

Bitcoin Gold (BTG) and Bitcoin Private (BTCP) has received a rating of D and D-, respectively. Likewise, Electroneum has received a rating of E+ as its technology and adoption is considered to be very weak.

Weiss makes an assessment about the worth of a cryptocurrency, based on the following details.

- Risk Index – based on price and volatility.

- Reward Index – based on historical buying and selling pattern.

- Technology Index – based on the review of source code and white paper.

- Adoption Index – based on adoption, settlement time, and transaction speed.

Weiss Ratings was founded in 1971. It currently covers 55,000 institutions and investments. Unlike other major financial rating agencies such as S&P, Fitch, Moody’s, and A.M.Best, Weiss do not accept payment of any kind from the entities it rates. The US Government Accountability Office (GAO), Barron’s, and several media publications have mentioned about its independence and accuracy in the past.

The blockchain-based real-time gross settlement system (RTGS) provider RippleNet’s platform is being piloted by a number of banks and financial organizations across the world. These organizations continue to provide feedback regarding the performance of the blockchain network, which enables quick transmission of payments at low costs.

The blockchain-based real-time gross settlement system (RTGS) provider RippleNet’s platform is being piloted by a number of banks and financial organizations across the world. These organizations continue to provide feedback regarding the performance of the blockchain network, which enables quick transmission of payments at low costs.

One such organization named Currencies Direct, a Europe based Forex payments provider, has issued an update regarding the xRapid platform, which was piloted by them. The foreign exchange provider, which carries out transactions worth $5.9 billion, announced their testing of the xRapid platform in October 2017.

Currencies Direct’s CPO Brian Harris was in total praise of the xRapid platform. Harris said

“Our trial with XRP was a resounding success. We’re currently assessing our next steps, but the evidence we’ve gathered indicates that the use of XRP is a game changer, making payments near-immediate and significantly improving service to our customers.”

Harris further stated that the financial services industry will increasingly start using cryptocurrencies for transfer of value. He believes that cryptocurrencies are better suited for this purpose rather than a store of value.

Harris said “…we’re proud to be leveraging new technology to deliver the most convenient and seamless experience for our customers.”

The xRapid platform facilitates end-to-end tracking, while saving costs to the tune of 60% to 70%. Furthermore, the transactions are completed quickly. Notably, financial institutions will have no need to maintain nostro and vostro accounts for cross-border transactions. Therefore, a lot of money, which is usually locked up in nostro and vostro accounts, can be put to better use.

Asheesh Birla, SVP of Product at Ripple commented

“xRapid offers an enhanced payments experience, while also allowing payment providers to gain a competitive advantage in the market.”

While brimming with pride for being the early adopter of the technology, Harris also stated that xRapid platform offers a revolutionary step for the financial industry.

In case of xRapid platform, the required liquidity is provided by the XRP tokens. The currency, which is being remitted is transferred into XRP on the XRP Ledger and the transaction is completed within a few minutes. Usually, it takes at least 2-3 days for completing a cross-border transaction using the traditional remittance system that uses SWIFT.

Verge (XVG) cryptocurrency, which claims to offer features such as anonymity, security, and privacy, is turning out to be more of a joke within the cryptocurrency domain, with a series of 51% attack waged at the will of hackers.

Verge (XVG) cryptocurrency, which claims to offer features such as anonymity, security, and privacy, is turning out to be more of a joke within the cryptocurrency domain, with a series of 51% attack waged at the will of hackers.

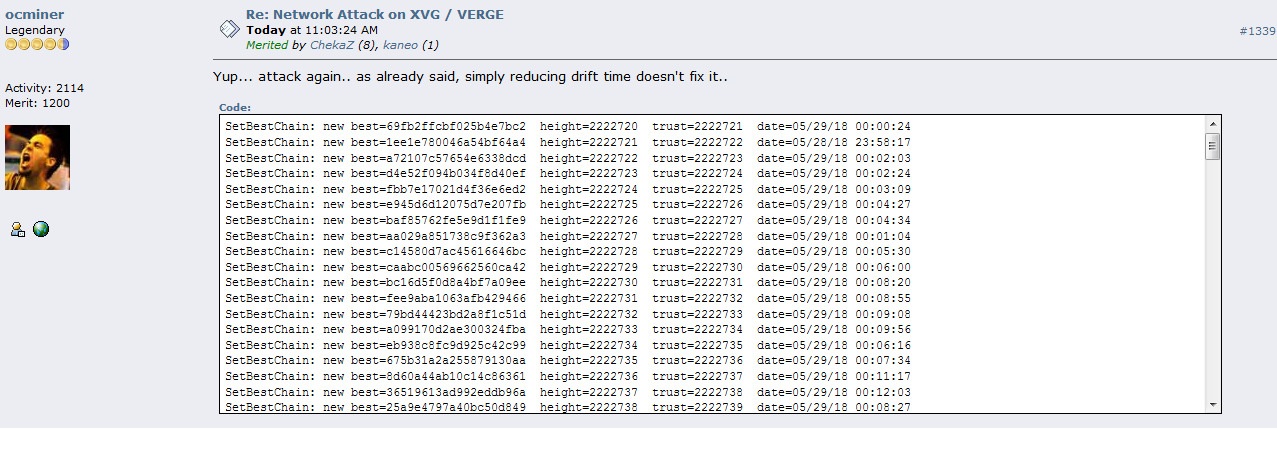

According to a posting made by ‘ocminer’ in the Bitcoin Talk forum, the security of Verge network has been compromised once again. Notably, ‘ocminer’ was the first person to alert about the previous two attacks. Millions of dollars worth Verge (XVG) token was swindled during the past two attacks.

On April 8, we had reported that Verge was subject to a 51% attack that resulted in a loss of 250,000 XVG tokens. Verge responded with a hard fork, but the hacker vouched to come back again to exploit the software bugs. On May 22nd, Verge suffered another hacking incident, almost identical to the previous one.

In the Bitcoin Forum thread titled “Network Attack on XVG / Verge”, “ocminer” says

“Yup… attack again.. as already said, simply reducing drift time doesn’t fix it..”

During the second time, the hacker was able to generate ~35 million XVGs as mining rewards, worth above $1.7 million, using the attack. Following the attack, Verge again implemented a hardfork. However, at that time, Redit user R_Sholes had pointed out that the vulnerability still exists. Again, Verge team downplayed the hacking incident as a “denial-of-service (DDos)” attack on some of the Verge mining pools. However, coding experts had clearly mentioned that it is much more than a simple DDos attack.

How the hacker did it?

Verge uses a different kind of protocol to maintain its network. The protocol known as Dark Gravity Wave difficulty adjustment algorithm automatically adjusts the mining difficulty at the end of every block. Notably, Bitcoin adjusts its mining difficulty at the end of every 2016 blocks. Verge uses five different hashing algorithms (Scrypt, Myr-Groestl, Lyra2Rev2, Blake2s, x17), switching to a new one for every block.

Depending on the use, the hashrate security is split among the algos. Verge, being a decentralized system, allows incorrect time stamping. Last time, this feature of Verge was exploited by the hacker who submitted multiple blocks with incorrect timestamp. The system mistook it as arrival of blocks at a different time and lowered the difficulty by as much as 99.99%. As the hashrate is split among five algos, the hacker was able to reign over the network and directed all the rewards to his own wallet.

During the second time, the hacker attacked two algorithms, Lyra2re and Scrypt, instead of one. The hacker was able to get around the fix put in place last time by Verge team. At the peak of the second attack, the hackers managed to mine 25 blocks (~8250 XVG tokens) per minute.

United States

United States United Kingdom

United Kingdom