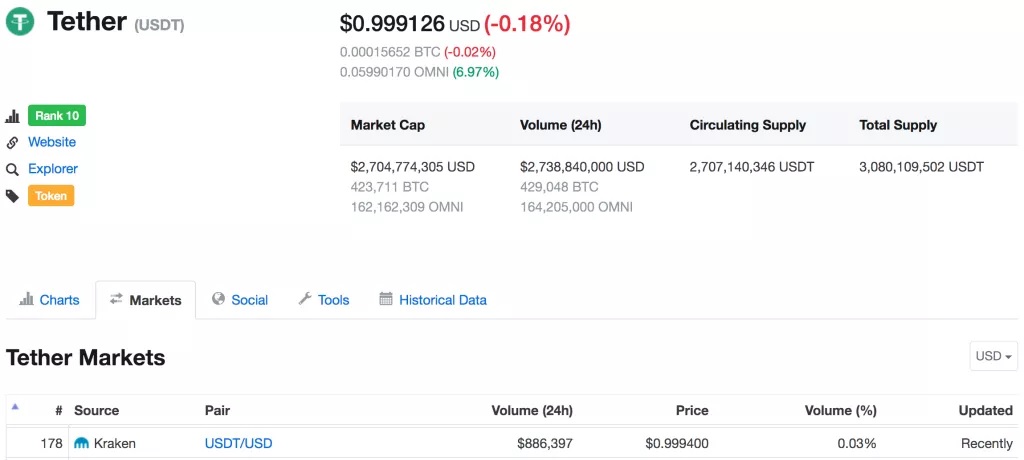

Bloomberg’s article titled “Cryptocoin Tether Defies Logic on Kraken’s Market, Raising Red Flags” was trying to prove that Kraken exchange is being used to manipulate the demand for Tether, a stable coin pegged to the US dollar on a 1:1 ratio. The article tried to create a notion that large transactions originating from Tether was not mirroring trades conducted within Kraken. Bloomberg further interpreted that it might be due to wash-trading. In a scathing response, Kraken exchange has pointed out the flaws in Bloomberg’s report.

Bloomberg’s article titled “Cryptocoin Tether Defies Logic on Kraken’s Market, Raising Red Flags” was trying to prove that Kraken exchange is being used to manipulate the demand for Tether, a stable coin pegged to the US dollar on a 1:1 ratio. The article tried to create a notion that large transactions originating from Tether was not mirroring trades conducted within Kraken. Bloomberg further interpreted that it might be due to wash-trading. In a scathing response, Kraken exchange has pointed out the flaws in Bloomberg’s report.

In its blog post, Kraken begins by saying that Bloomberg news doesn’t have a grasp on fundamental concepts of financial markets. Kraken says

“Bloomberg News inexplicably fails to comprehend basic market concepts such as arbitrage, order books and currency pegs.”

Kraken has also stated that it is appalled by the “applause” the article has received from other “journalist lemmings”. By supporting the article, the reputation of the reporters has fallen off the cliff, Kraken said. While pointing out how the article defies logic, Kraken has also appreciated the cryptocommunity for shattering the “Tether takedown”, listing a countless number of social media responses berating the article.

The exchange has rightly highlighted its worries about ignorant lawmakers who may pick up the opinion on incomplete information and take it as empirical evidence. The post says “It’s scary to think that our lawmakers are reading this stuff. The title sure was sensational, and it undoubtedly grabbed eyeballs but what of the readers who are not following the outrage on Reddit and Twitter? What of those who rely on the journalistic integrity and expertise of their news sources?”

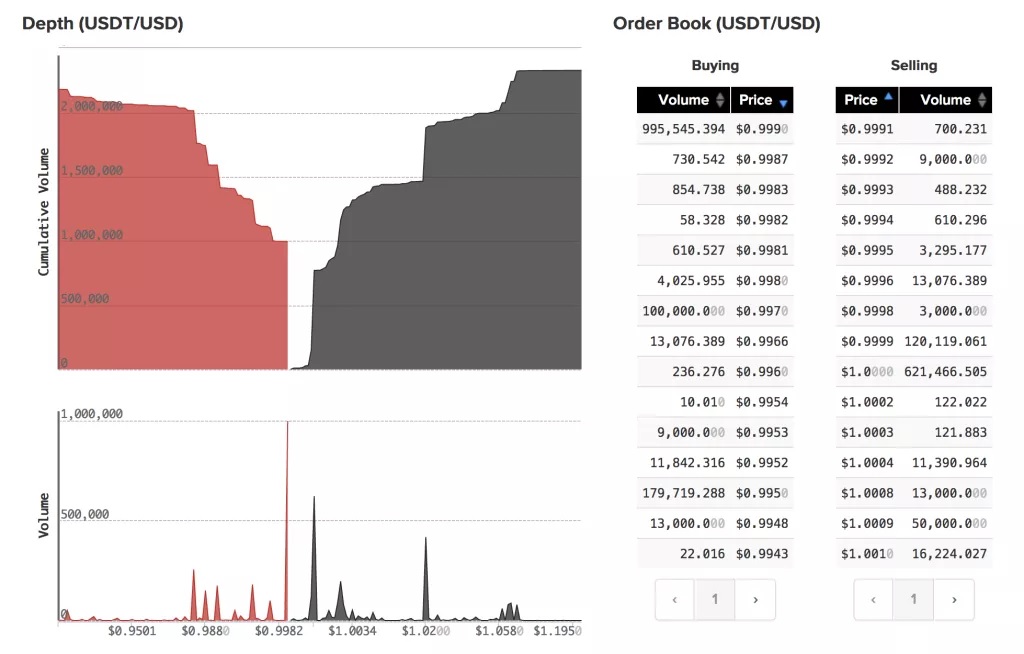

Kraken has refuted claims made by Bloomberg’s article, clause by clause. The rebuttal also elaborates on how USDT works. Kraken explains how Tether manages to stay stable through arbitrage and the manner is which it is collateralized with the greenback. The post also underlines the illogic of being labeled as the arbiters of Tether, referring their less than 1% of overall Kraken volume through 1H2018.

Referring to the alleged manipulation, the blog states that it would be idiocy to select USDT for wash trading due its repute as a pegged currency.

“If you’re looking around for potential wash trading in USDT, we recommend you look elsewhere. That said, it’s not clear what harm could come from wash trading of a pegged asset against its peg. In Kraken’s case, USDT is only traded against its peg, USD, which itself is an explicitly manipulated asset.”

United States

United States United Kingdom

United Kingdom